- Market Overview

- Futures

- Options

- Custom Charts

- Spread Charts

- Market Heat Maps

- Historical Data

- Stocks

- Real-Time Markets

- Site Register

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmer's Almanac

- USDA Reports

Analysts Think This ‘Strong Buy’ Consumer Staples Stock Can Break Free of China. Should You Buy Shares Now?

Sharkninja (SN) is a product designer focused on “5-star” lifestyle solutions for its customers around the globe. The company is known for making innovative products in home categories such as cooking, cleaning, home environment, and beauty. It also produces well-known food preparation products such as blenders, ice cream makers, juicers, and more.

About Sharkninja Stock

Sharkninja is relatively new in the market, with the company going public on July 31, 2023, after a spinoff from its parent company, JS Global Lifestyle. The company is valued at $13.89 billion and has gained an impressive 40% in the last month. The stock has gained 46% in the 52-week timeframe.

Sharkninja’s Financial Results

Sharkninja posted its first-quarter 2025 results last week on May 8, posting an adjusted profit of $0.87 per share. The figure exceeded analysts’ estimate of $0.73 per share. The technology company generated revenue of $1.22 billion, reflecting a 14.7% increase year-over-year while outpacing analysts’ $1.07 billion estimate.

Sharkninja’s sales figure rose 15.1% domestically and 13.7% internationally. The company cited unfavorable effects from the change in business model from distributor to direct model in Mexico and Easter timing with new product launches in the United Kingdom as key factors for reduced international growth.

Gross margin slipped 10 basis points while adjusted EBITDA decreased 13.1% to $200.4 million. The company ended the quarter with a cash balance of $224.7 million, down from $363.67 million reported in the same quarter last year.

For FY25, Sharkninja has raised its full-year outlook and now anticipates an 11% to 13% rise in net sales. Earnings per diluted share are expected to be $4.90 to $5.00, and adjusted EBITDA is forecast between $1.09 billion and $1.11 billion.

Sharkninja was up 13% on May 8 following the results.

Sharkninja to Move out of China

Sharkninja plans to fully diversify out of China and Wall Street anticipates the company might be able to do it before the year ends. This gives the company a “multi-year head start on competitors,” as per analyst Randal Konik from Jefferies. Bank of America analyst Alexander Perry has updated that the company has already shifted its sourcing to other countries like Vietnam and Cambodia.

The move has seen the stock upgraded by a host of analysts across Wall Street. Bank of America has reiterated its “Buy” rating while raising its price target to $125 and labeling the stock as a “top pick.” Goldman Sachs also maintained its “Buy” rating on the stock while upping its price target from $100 to $112. Oppenheimer has reaffirmed its “Outperform” rating with a target increase to $120.

Analyst Ratings on SN Stock

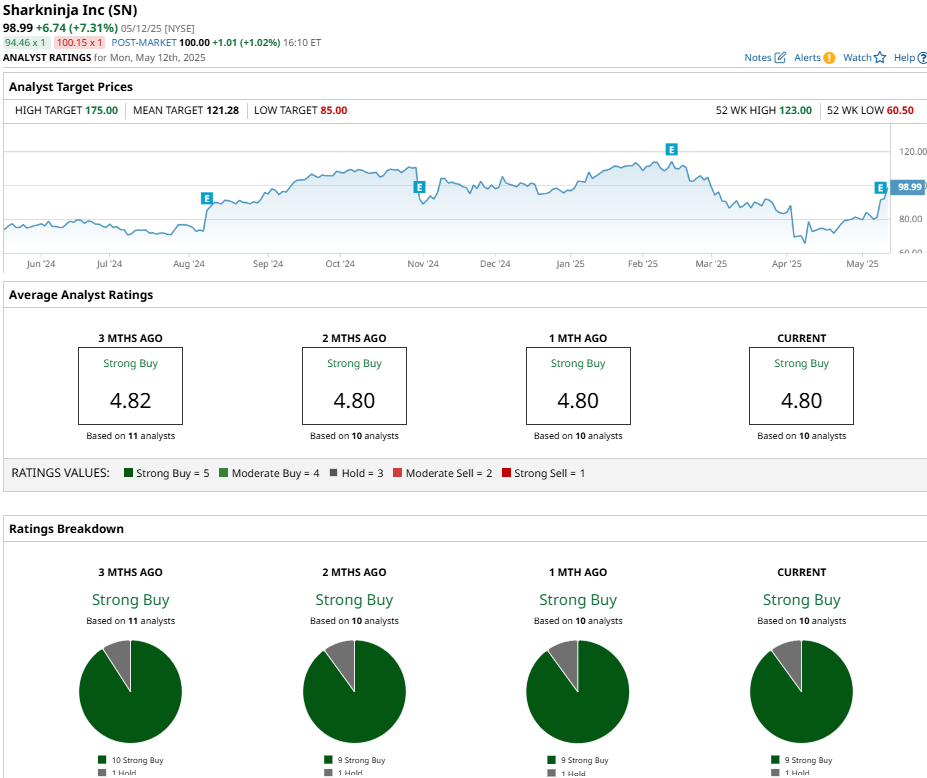

Analysts have been impressed with the innovative product company and have a “Strong Buy” consensus rating with a mean price target of $123.17 which points toward potential upside of 20% from market price.

The stock is covered by 10 analysts and has received nine “Strong Buy” ratings and one “Hold” rating on Wall Street.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.